Financial Statements of the Government of New Zealand for the three months ended 30 September 2018

The Financial Statements of the Government of New Zealand for the three months ended 30 September 2018 were released by the Treasury today. The statements are compared against forecasts based on the 2018 Budget Economic and Fiscal Update (BEFU 2018) published on 17 May 2018.

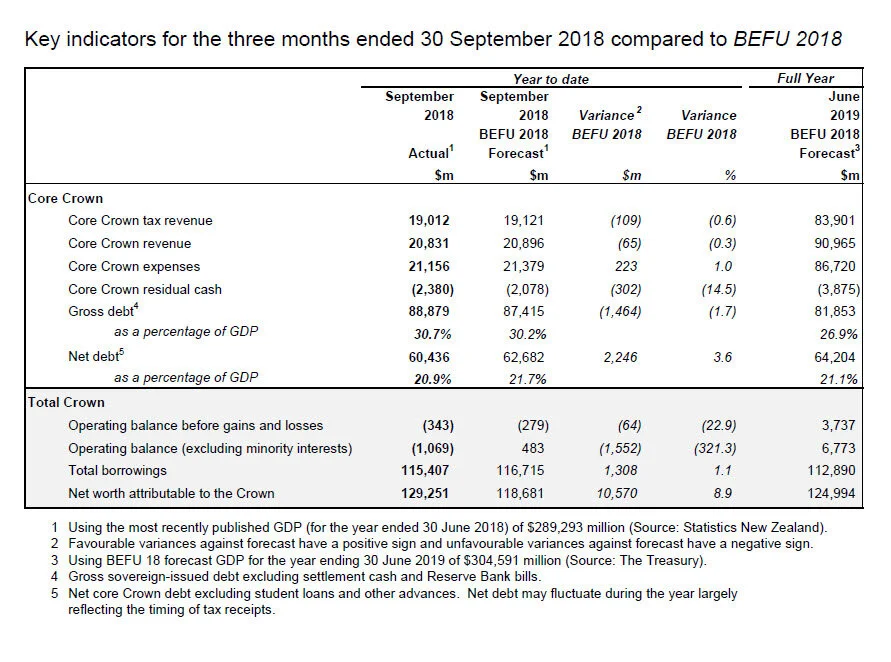

Core Crown tax revenue at $19.0 billion was in line with the BEFU 2018 forecast. Corporate tax revenue was below forecast by $0.3 billion (12.3%), mainly due to 2018 income tax assessments lodged since June, indicating taxable profits in the 2018 tax year were lower than forecast. The corporate tax revenue result should not be an indicator of growth or otherwise in recent corporate profitability. The less-volatile receipts measure of corporate tax is on forecast and 8.2% up on the same period last year.

Core Crown expenses of $21.2 billion were $0.2 billion (1.0%) below budget. This variance was largely due to the Working for Family Tax Credit being lower than expected and a lower than forecast sovereign receivables impairment.

The operating balance before gains and losses (OBEGAL) was close to forecast, at a $0.3 billion deficit. Tax revenue in the first quarter of the year tends to be less than what is recognised over the rest of the year, while expenses are generally more evenly spread across the year. As a result we expect the deficit reported in the September Financial Statements to reverse in the coming months.

When gains and losses are added to the OBEGAL result, the operating balance was a $1.1 billion deficit, $1.6 billion less than forecast. Net investment gains of $1.5 billion were recorded offset by net losses on non-financial instruments of $2.3 billion.

Core Crown residual cash was a deficit of $2.4 billion, $0.3 billion higher than the deficit forecast.

Net core Crown debt was $60.4 billion (20.9% of GDP) at the end of September 2018, $2.2 billion less than forecast. The lower than expected net debt is largely due to a stronger opening position, from the 30 June 2018 result (which was $2.9 billion less than forecast). This was partially offset by the residual cash variance of $0.3 billion.

Net worth attributable to the Crown (NWAC) was $129.3 billion, $10.6 billion higher than forecast at BEFU 2018. The majority of this variance relates to property, plant and equipment revaluations increasing NWAC by $10.7 billion at 30 June 2018.

The Treasury - ENDS